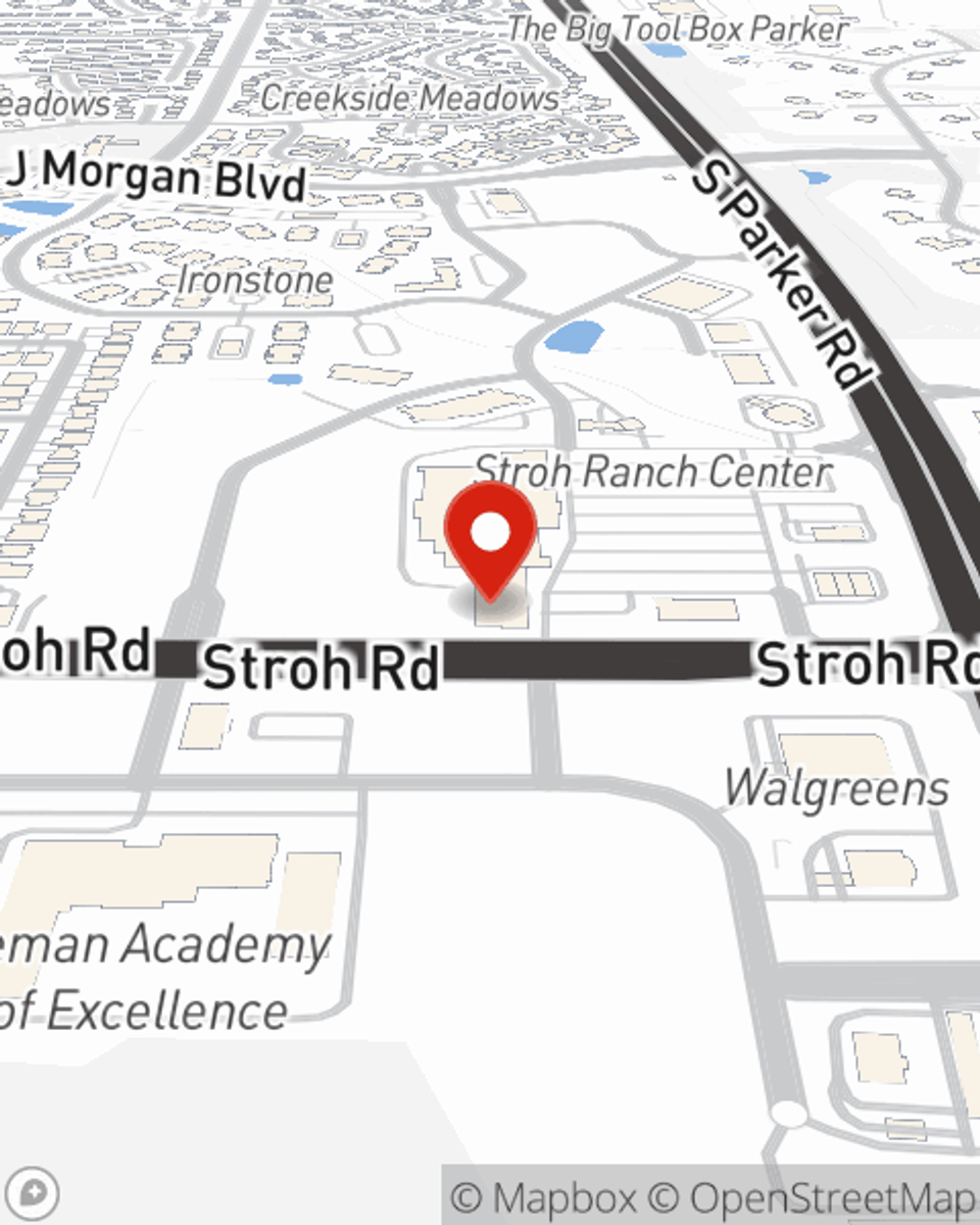

Business Insurance in and around Parker

Get your Parker business covered, right here!

No funny business here

- Castle Rock

- Lone Tree

- Franktown

- Elizabeth

- Douglas County

- Pradera

- Pinery

- Timbers

- Stroh Ranch

Insure The Business You've Built.

The unexpected happens. It's always better to be prepared for the unfortunate problem, like a customer hurting themselves on your business's property.

Get your Parker business covered, right here!

No funny business here

Insurance Designed For Small Business

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like extra liability or worker's compensation for your employees, that can be molded to develop a personalized policy to fit your small business's needs. And when the unexpected does occur, agent Joe Bussey can also help you file your claim.

Intrigued enough to research the specific options that may be right for you and your small business? Simply call or email State Farm agent Joe Bussey today!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Joe Bussey

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.